The growing demand for energy-guzzling

artificial intelligence

workloads is fueling renewed interest throughout the nuclear power space. Google’s

(GOOG)

The announcement of partnering with nuclear developer Elementl Power to fund and construct three advanced reactor sites indicates that companies in the nuclear sector anticipate benefiting from this significant transformation.

The proposed sites each would provide a minimum of 600 megawatts of baseload power, a capacity that technology titans are clamoring to tap to satisfy the rapidly growing demand for

data centers

.

Don’t Miss a Day:

Whether you’re interested in crude oil or coffee, join Dailyexe now at no cost for top-tier commodity analysis.

In the midst of numerous competitors vying for prominence throughout this nuclear resurgence, one speculative yet potentially rewarding prospect stands out: Asp Isotopes.

(ASPI)

, with a

a market capitalization of $435 million

The company’s focus on isotope enrichment technology syncs well with the promising outlook for advanced reactors and radiopharmaceuticals—industries seeing increasing demand. Given its low market cap and high volatility, ASPI stands out as one of those risky yet potentially rewarding investments beginning to attract investor attention.

Regarding ASPI Stocks: The Case of Asp Isotopes (ASPI)

Asp Isotopes

(ASPI)

, which is U.S.-listed, is dedicated to commercializing next-generation, non-uranium-based isotope enrichment technologies. Based in Florida, the firm aims to develop applications in clean energy, industrial use, and medicine. Its core pursuit is commercializing the manufacturing of medical and industrial isotopes via its proprietary Aerodynamic Separation Process, with the potential to break traditional isotope supply chain models. A pre-revenue business, ASPI generated annual sales of only $4.1 million while recording an annual net loss of over $32 million, which indicates that it is still an early stage business with an R&D-intensive business model.

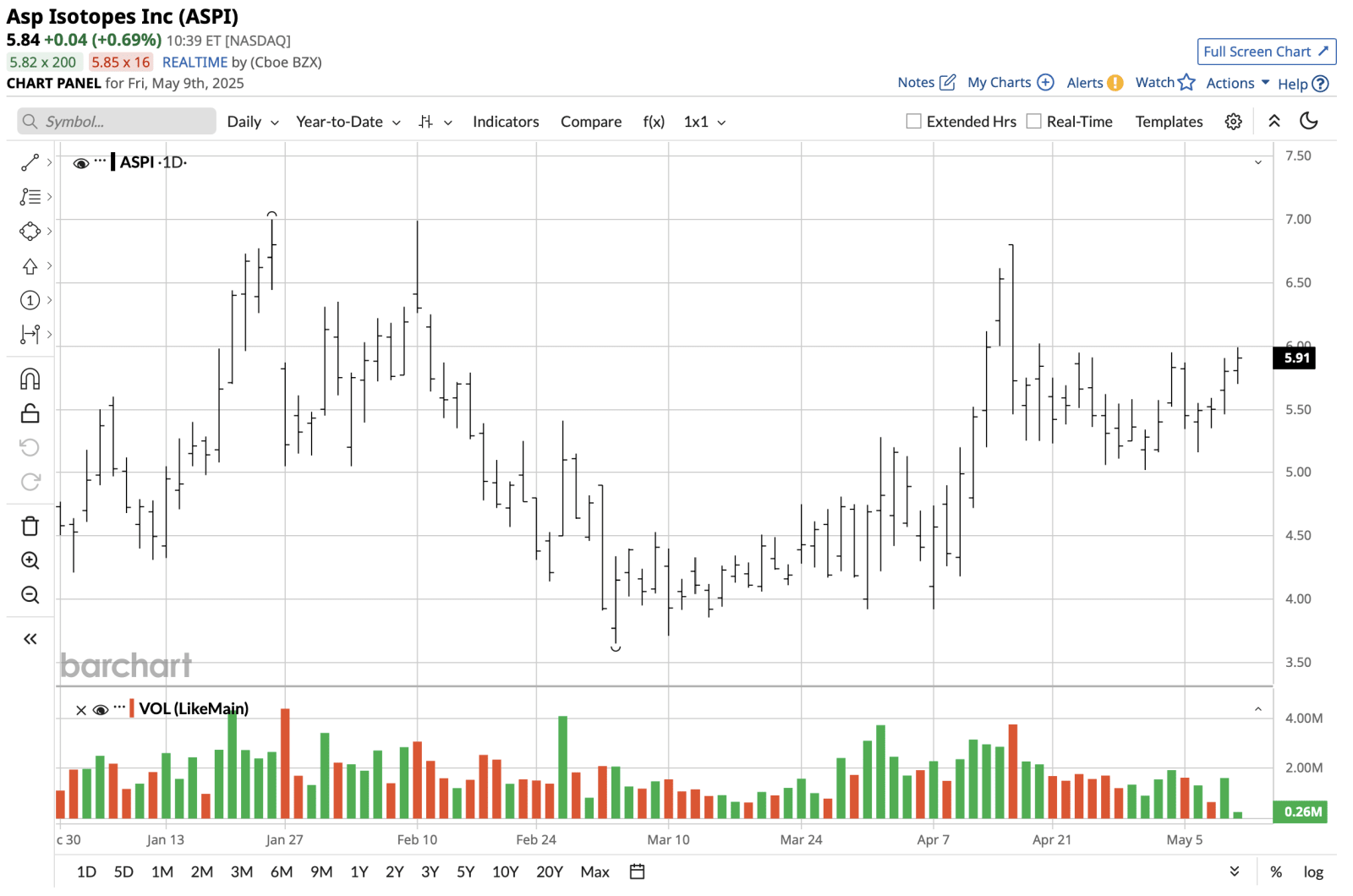

In the last 12 months, ASPI has exhibited remarkable volatility, reflecting its speculative character. As of now, the stock has surged by 33.4% this year, significantly outperforming the S&P 500 Index.

($SPX)

A minor setback. This outcome seems to stem from increasing investor enthusiasm for nuclear energy collaborations along with speculative funds moving towards smaller companies involved in climate-related infrastructure projects.

From a valuation standpoint, ASPI trades at an astonishingly high price.

price-sales ratio of 99.62x

And a price-to-book ratio of 7.67x. These numbers suggest high expectations for future expansion, despite the absence of profits and negative cash flow indicating substantial execution risks. Given a return on equity of -107.4% and an interest coverage ratio of -123.3, the stock appears significantly overpriced based on traditional measures. Nonetheless, should its technology land contracts or gain endorsement from either government agencies or private firms, this speculative valuation might be justified.

ASP Isotope Profits Reveal Initial Phase Losses

Isotopes Asp is still in the initial stages of commercializing its products, and its financials reflect the truth of operating as a development-stage company without revenue.

In 2024, the firm announced a net loss totaling $0.63. Despite having just one forecast for 2025,

expected EPS of -$0.08,

This represents a notable advancement compared to the prior year, suggesting a reduction in the deficit as the company moves towards expanded operations. There are currently no estimates available.

for upcoming quarters or the fiscal year 2026

The upcoming earnings announcement might offer further clarity on business achievements and expense trends. Until then, stakeholders ought to view ASPI as a wager on prospective income over an extended period, instead of expecting immediate profits.

In early May, Google declared a substantial initial-stage investment in three nuclear energy projects spearheaded by Elemental Power. These installations aim to supply AI-driven data centers with round-the-clock base-load power—a crucial necessity due to the escalating global demand for AI processing capabilities. By supporting Elemental Power, Google reflects an emerging pattern among leading technology companies: they are venturing into energy production to secure sustainable, dependable, and expandable electrical resources.

Although ASPI isn’t directly linked with Elementl Power, the recent news has boosted enthusiasm for stocks related to nuclear energy, particularly those involved in isotope tech such as ASPI. The firm’s Aerodynamic Separation Process holds potential strategic importance for generating enriched isotopes needed in future reactor designs or sophisticated diagnostic tools—both sectors expected to thrive due to increased interest in nuclear power.

What Are Analysts Forecasting for Asp Isotopes Stock?

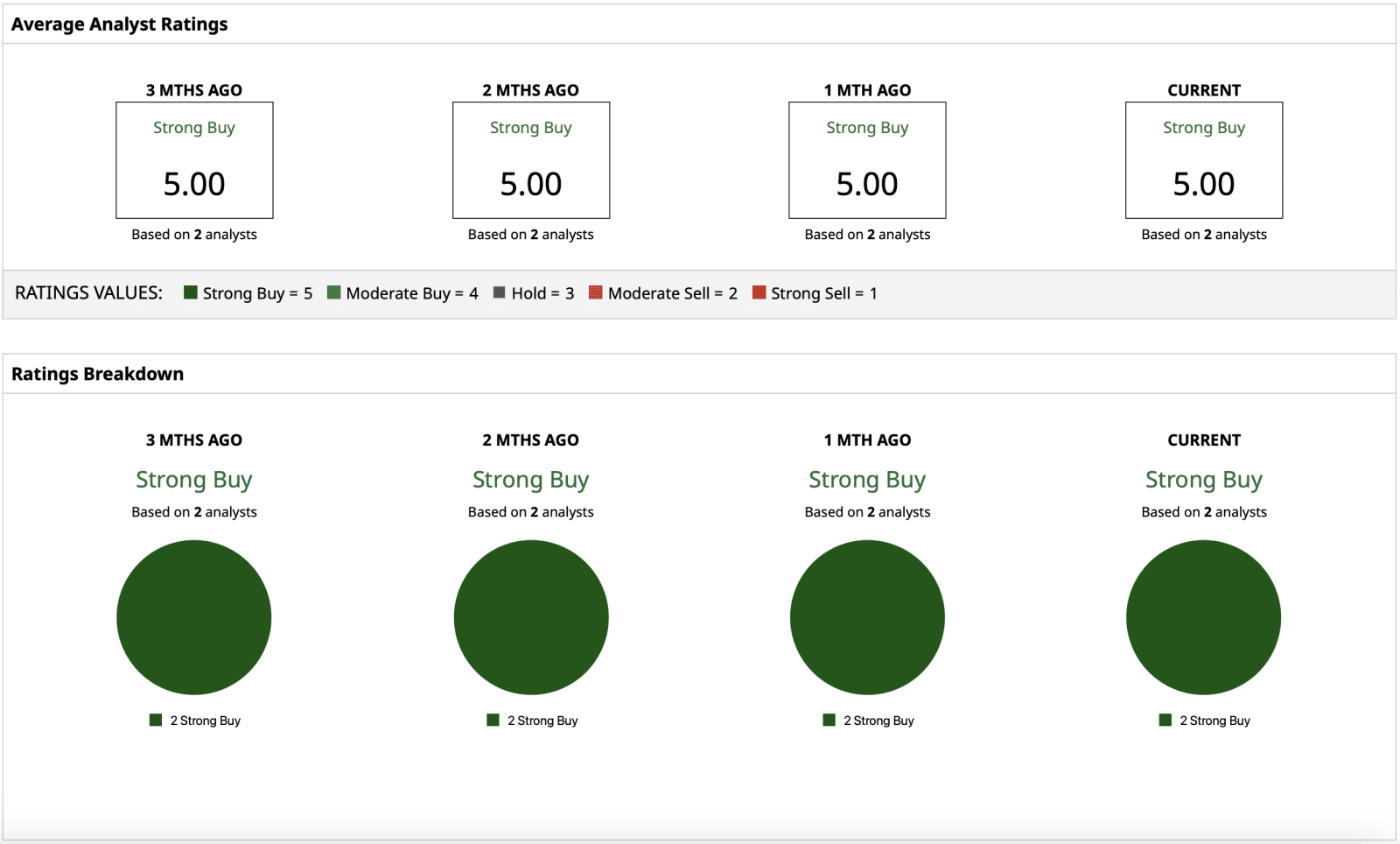

Two analysts who cover Asp Isotopes have kept their positions.

“Strong Buy” ratings

Over the last three months, both analysts have shown strong confidence in the stock, despite the risks associated with an early-stage business. The average score of 5.00, which is the maximum achievable on Dailyexe, reflects unanimous optimism.

Regarding price targets, the average estimate stands at $6.50, indicating about 8% growth potential from today’s share price. The highest projection reaches up to $8.50, suggesting an approximate increase of 40%. Conversely, the lowest forecast is set at $4.50, positioning itself beneath the present market value.

This close group of objectives set by both analysts suggests a cautiously optimistic agreement, which could lead to a reassessment upon the firm forming strategic alliances or increasing production levels.

Upon release,

Yiannis Zourmpanos

did not hold (directly or indirectly) any stakes in the securities mentioned within this article. This piece contains information and data intended purely for informative purposes. For additional details, refer to the Dailyexe Disclosure Policy.

here

.

More news from Dailyexe

・

Google Is Investing Heavily in Nuclear Power. Consider This Top-Recommended Stock for Purchase Today.

・

Could Donald Trump Boost Oklo Stock?

Here are three more varied versions:

1. Is There Potential for Donald Trump to Enhance Oklo’s Share Price?

2. Might Donald Trump Give Oklo’s Stock Performance an Upward Push?

3. Can Donald Trump Energize Interest in Oklo Shares?

・

Mizuho Believes This Purchase-Recommended Hydrogen Stock Could Rise 57% by 2025

・

Is the WTI Crude Oil Market Logical?