Elon Musk enjoys making ambitious assertions. While some of his declarations turn out to be accurate, numerous others fail to materialize. Most recently, he has expressed his belief that

Tesla

(NASDAQ: TSLA)

could potentially become the most valuable company globally one day, suggesting that it might be worth more than the subsequent five largest firms combined.

market capitalization

Today, shares like

Nvidia

collectively have a market capitalization exceeding $10 trillion.

Tesla’s market capitalization currently stands below $900 billion, suggesting that Elon Musk believes the company could potentially increase in value by approximately tenfold from this point onward. Should investors consider purchasing Tesla shares at present? We’ll delve deeper into Musk’s assertions to determine whether his prediction holds water.

Where should you put your $1,000 investment at this moment?

Our analyst team just revealed what they believe are the

10 best stocks

to buy right now.

Continue »

A struggling car business

For several years, Tesla’s automotive division expanded steadily; however, it has stagnated recently. In the first quarter of this year, customer deliveries decreased by 13%, totaling 337,000 units compared to the previous year. Meanwhile, rival companies have gained ground across various markets worldwide. Additionally, the sector saw an annual decline in revenue of 20%. This downturn was more pronounced due to substantial discounts offered on their vehicles. Moreover, expectations surrounding the new Cybertruck model have fallen short as it continues to underperform and won’t contribute significantly to sales in the near future.

Tesla’s profit margins are declining, standing at 7.4% over the past twelve months, significantly reducing their earning potential. Should delivery volumes decrease further alongside reduced sale prices, maintaining an operational profit margin could become increasingly challenging for them as we move through the remainder of this year. Although they haven’t provided specific forecasts beyond 2025, current trends suggest that sales downturns may persist across 2023. Notably, declines in sales figures are being observed consistently within Tesla’s key regions: China, Europe, and North America.

Given that no new models have been announced so far — as revealed through official communications from the leadership team — it’s challenging to envision an optimistic outlook for Tesla’s car division moving forward. They might generate income from their upcoming Cybertruck and self-driving tech, yet this remains a speculative scenario since Tesla has long promised these advancements without delivering them. In contrast, competitors like Waymo currently manage around 250,000 automated trips each week.

And will it be beneficial enough for Tesla to reach a market cap of $10 trillion? That seems even more unlikely.

Can we rely on the Optimus Robot?

Elon Musk’s optimism for Tesla at the moment comes from the potential of the Tesla Optimus Robot, a humanoid robot the company is developing. He believes that if these robots have artificial intelligence (AI) software and can perform physical tasks for humans, there is a market for $10 trillion in revenue selling 100 million bots for $100,000 apiece. That is not a typo.

While $10 trillion in revenue sounds exciting, these are fantastical claims from the leader of Tesla. Tesla has never built a functioning humanoid robot. The robots at its demonstration were remotely controlled by humans. If it can get a working robot, it is hard to envision demand for 1 million units a year, let alone 100 million. There are only so many corporations and wealthy individuals that would buy these bots every year, if they ever get made in the first place.

Certainly, Musk has the liberty to assert however positive a number he desires. This doesn’t necessarily imply those numbers align with real-world economics.

The tough reality investors must acknowledge

Tesla investors are gradually coming to terms with an uncomfortable reality: The company’s shares have been inflated in value for quite some time now. At the start of 2021, the stock was trading slightly beneath $300. Currently, it sits below that mark at approximately $275, indicating that it might still be overpriced.

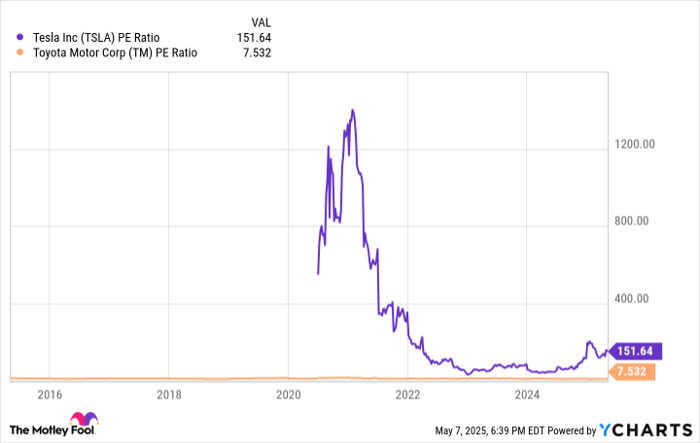

The Tesla share trades with a price-to-earnings ratio (P/E) of around 150. In contrast, most stocks within the automobile sector usually possess a P/E ratio nearer to 10.

Toyota Motors

In the provided chart, ‘a’ serves as a proxy for the industry because most trades occur within this range. It’s important to note that Tesla’s automotive revenue is currently decreasing by 20% annually, accompanied by unfavorable future projections.

The management team is making big promises about the Cybercab and Optimus Bot projects, but these ventures aren’t fully established companies just yet. It would be impressive if they manage to make them successful, however, this does not imply that purchasing shares at present prices would be considered affordable.

Even with the stock down and Elon Musk saying Tesla could be worth 10x its current market value someday does not mean you should buy the stock. When you peel back the layers of this onion, all I see is a struggling automotive business trading at an expensive P/E ratio. Stay far away from Tesla stock until further notice.

Don’t let this second chance for a potentially profitable opportunity slip away.

Have you ever felt like you’ve missed out on investing in the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a

“Double Down” stock

recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Nvidia:

if you invested $1,000 when we doubled down in 2009,

you’d have $302,503

!* -

Apple:

if you invested $1,000 when we doubled down in 2008,

you’d have $37,640

!* -

Netflix:

if you invested $1,000 when we doubled down in 2004,

you’d have $614,911

!*

Right now, we’re issuing “Double Down” alerts for three incredible companies,

available when you join

Stock Advisor

,

And this might not come around again for quite some time.

Check out these 3 stocks »

*Stock Advisor returns as of May 5, 2025

Brett Schafer

does not hold any shares in the stocks discussed. However, The Motley Fool holds positions in and recommends Nvidia and Tesla. The organization also has a

disclosure policy

.