The restaurant tech company PAR Technology (listed as NYSE:PAR), is set to release its results tomorrow prior to the stock market opening. Here’s what you should keep an eye on.

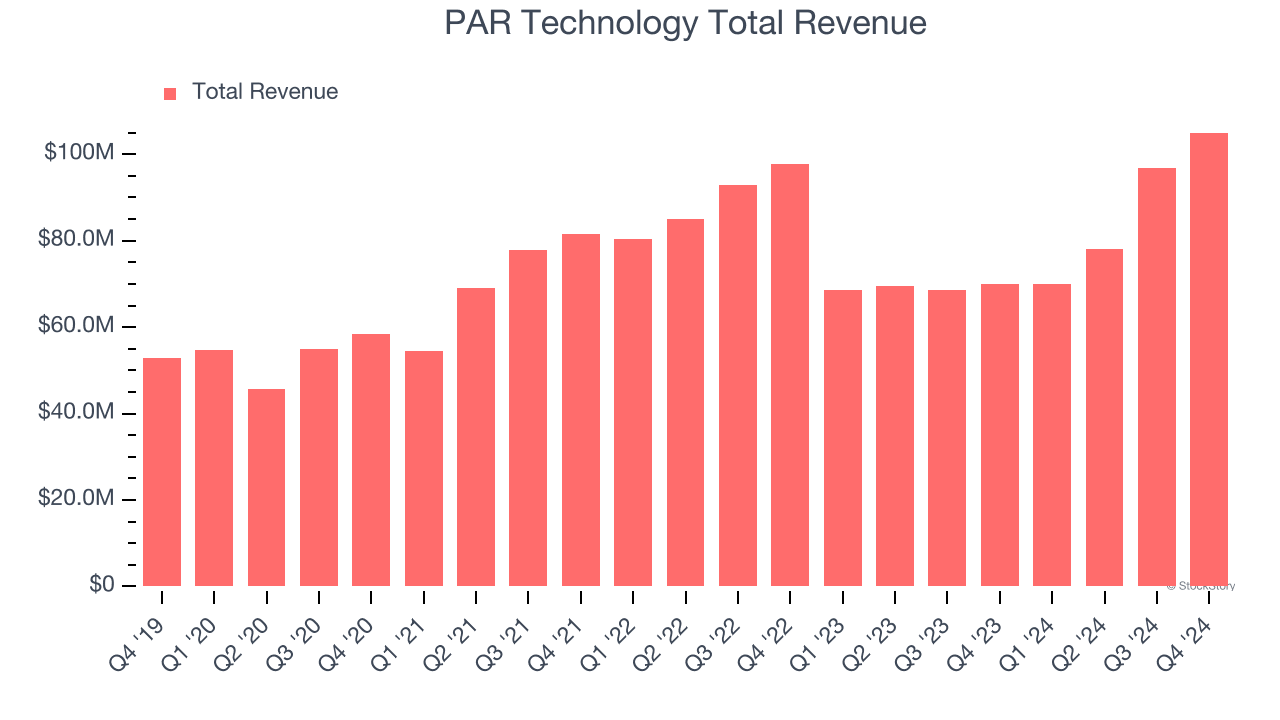

Last quarter, PAR Technology exceeded analyst revenue projections by 4.3%, announcing earnings of $105 million, which marks a 50.2% increase from the previous year. This was a remarkable period for the firm, as they not only surpassed expected Annual Recurring Revenue (ARR) figures but also delivered an outstanding performance against estimated Earnings Per Share (EPS).

Should one consider buying or selling PAR Technology stock before their earnings report?

Check out our comprehensive analysis; it’s available at no cost.

.

For this quarter, financial experts anticipate PAR Technology’s revenue to rise by 50.4%, amounting to approximately $105.4 million—a significant jump compared to the 2.2% growth reported during the corresponding period of the previous year. They also predict an adjusted loss of around -$0.04 per share.

Analysts who follow the company have largely kept their forecasts unchanged in the past month, indicating they believe the firm will maintain its trajectory as it approaches earnings season. Over the last couple of years, PAR Technology has fallen short of Wall Street’s sales expectations on six occasions.

When examining PAR Technology’s competitors within the niche tech sector, several have already unveiled their Q1 outcomes, offering insight into potential trends. Napco saw its revenue drop by 10.8% compared to last year but managed to surpass analyst predictions by 1.9%. On the other hand, Mirion posted an increase of 4.9% in revenues, exceeding forecasts by 0.6%. Following these announcements, Napco’s stock climbed by 4%, whereas Mirion’s share price rose slightly by 1.3%.

Review our comprehensive analysis here

Napco’s results here

and

Mirion’s results here

.

There has been positive sentiment among investors in the specialized technology segment, with share prices up 5.9% on average over the last month. PAR Technology is up 8.5% during the same time and is heading into earnings with an average analyst price target of $87 (compared to the current share price of $62.62).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified

a comparatively lesser-known stock experiencing robust growth due to the advancement of AI technology, offered to you at no cost through this link

.