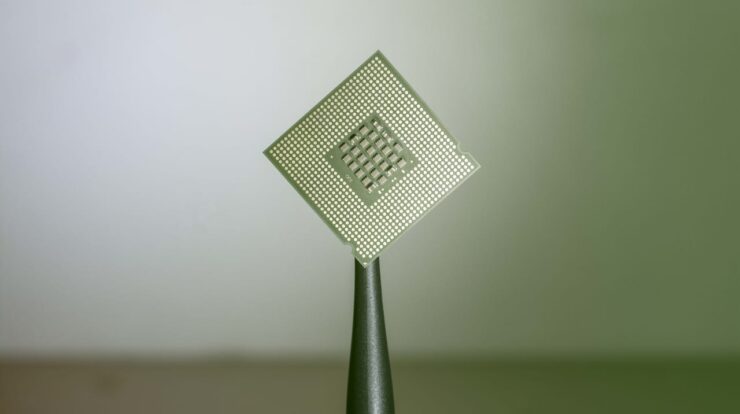

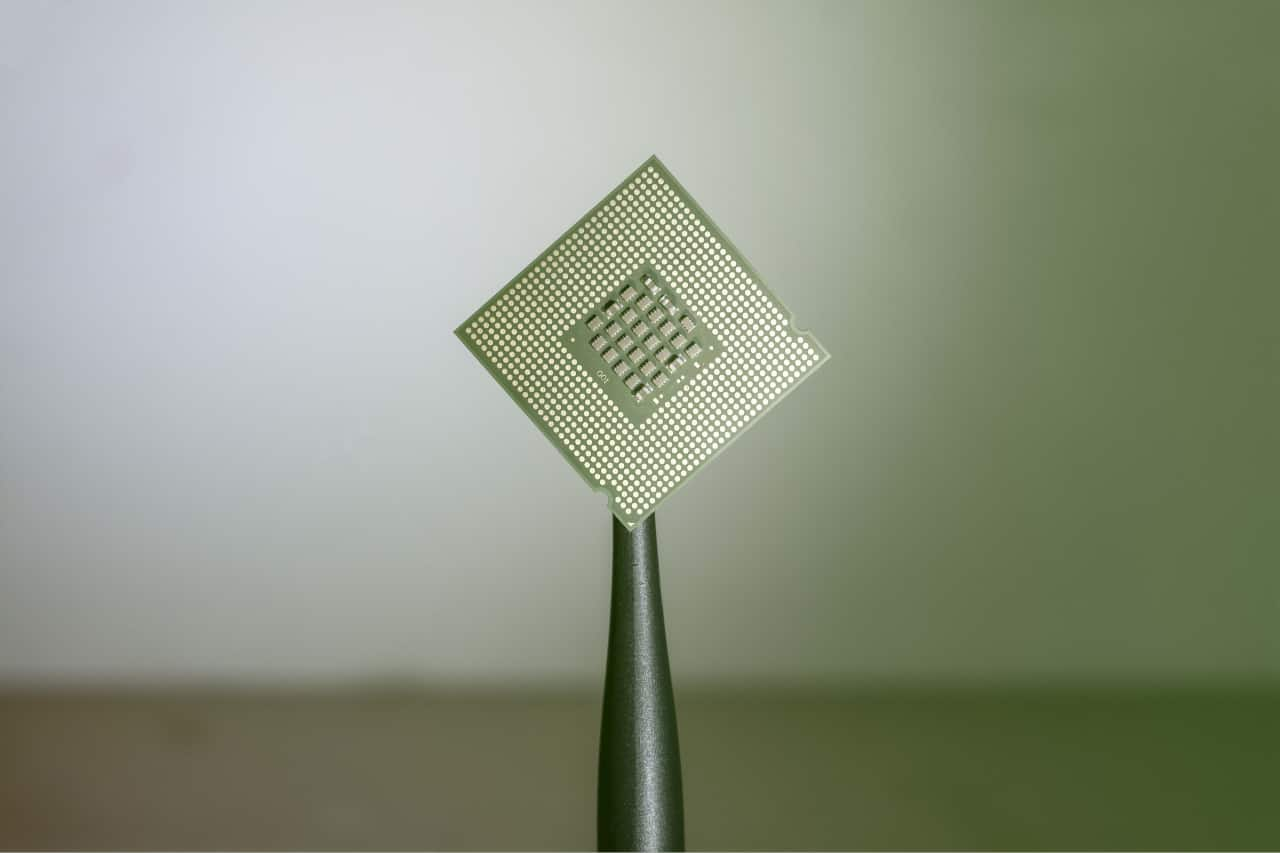

On Friday, Microchip Technology saw an uptick as the manufacturer of basic semiconductor components and circuitry for electronic devices surpassed expected profit figures for their fiscal fourth quarter and increased projections for the present first quarter. Nonetheless, experts continue to show differing opinions regarding the potential extent of further gains in the company’s stock price.

For the quarter ending on March 31, the firm announced adjusted profits of 11 cents per share with revenues totaling $971 million. This performance surpassed analysts’ expectations, which were set at 10 cents per share and $963 million in sales, respectively.

Microchip shares rose 12% to $55, buoyed by management’s improved forecasts for the fiscal first quarter of 2026. Shares of Microchip remain 45% below their all-time closing high of $99.49 on May 22, 2024, according to Dow Jones Market Data.

The firm upgraded its first-quarter revenue forecast to a range of $1.02 billion to $1.07 billion and boosted its earnings outlook to 26 cents per share from 18 cents.

The favorable report “signifies the end of this extended downturn in the industry for Microchip,” stated CEO Steve Sanghi, who came back to head the company last year after a thirty-year tenure as chief executive that concluded in 2021.

Piper Sandler’s analysts concurred with Sanghi’s evaluation, elevating their rating from Hold to Buy due to substantial anticipated demand from Microchip’s distribution channels.

The analysts noted in their report following the earnings announcement, “We believe that MCHP has the potential for significant recuperation and expansion within a brief timeframe.”

Craig Ellis and Stacy Che from B. Riley Securities maintained an optimistic stance, keeping their Buy recommendation and raising their price target to $75—which stands as the highest on Wall Street, per FactSet—up from their earlier forecast of $60.

Not everybody shared this optimism. According to analysts at Truist Securities, Microchip’s present valuation lacked appeal, despite the belief that the company might have reached its lowest point.

“Stay on the sidelines for now,” the analysts wrote, as they maintained a Hold rating on the stock and bumped their price target to $52 from $43.

Vivek Arya from Bank of America Securities commended Microchip’s progress under Sanghi, though he cautioned that the firm still had significant ground to recover. In response, Arya raised his rating on the stock from Underperform to Hold.

Send your message to Nate Wolf at

[email protected]