Micron

(MU) is among the stocks that have been closely monitored by Dailyexe visitors recently. Therefore, it could be beneficial to examine some elements that may influence the short-term performance of the stock.

Over the last month, shares of this semiconductor company have surged by +21.6%, outperforming the Zacks S&P 500 Composite Index’s gain of +13.7%. Within the same timeframe, the Zacks Computer – Integrated Systems industry group, which includes Micron Technology, has seen an increase of 24%. So now, the crucial question remains: What direction might the stock take in the short term?

Even though news stories or gossip regarding a major shift in a firm’s future performance often result in fluctuations of its stock prices and prompt swift adjustments, underlying fundamentals invariably play a key role in shaping long-term investment choices.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the change in the projection of a company’s future earnings over anything else. That’s because we believe the present value of its future stream of earnings is what determines the fair value for its stock.

Our assessment primarily hinges on tracking adjustments made by sell-side analysts who cover the stock, particularly in response to recent developments in business conditions. As these forecasts for corporate profits increase, so does the estimated intrinsic worth of the stock. Consequently, should an equity’s theoretical valuation exceed its present trading price, investors typically respond by purchasing said shares, driving prices upwards. Therefore, research findings consistently show a robust connection between shifts in profit projections and fluctuations in share values over shorter timeframes.

Micron is anticipated to report earnings of $1.57 per share for the present quarter, reflecting a year-over-year increase of +153.2%. In the past month, the Zacks Consensus Estimate has not changed.

For the present fiscal year, the average projected earnings of $6.85 indicate a rise of approximately +426.9% compared to the previous year’s figures. In the past thirty days, this estimate has not undergone any modifications.

For the upcoming fiscal year, the average projected earnings of $10.79 suggest an increase of 57.5% compared to what Micron is anticipated to report for the previous year. In the last thirty days, this estimate has been revised downward by 0.2%.

With a robust externally verified performance history, our exclusive stock evaluation system, known as the Zacks Rank, provides a clearer view of a stock’s short-term price movement by leveraging the impact of adjustments in profit forecasts. Given the substantial shift in the average analyst prediction recently, coupled with three additional elements linked to these predictions, Micron receives a Zacks Rank #3 classification (Hold).

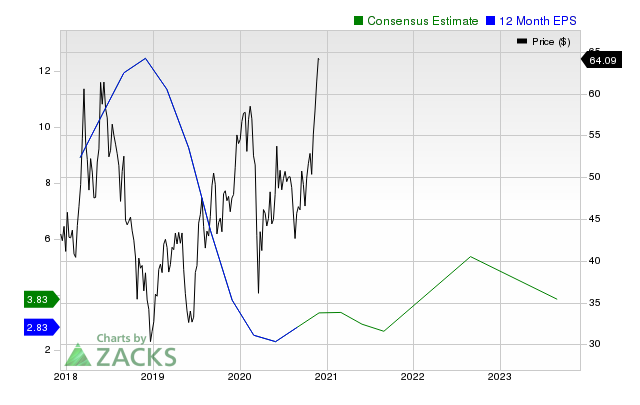

The chart below shows the evolution of the company’s forward 12-month consensus EPS estimate:

12 Month EPS

Revenue Growth Forecast

Although a firm’s earnings growth might be considered the most reliable gauge of its fiscal well-being, not much can occur if it fails to boost its sales. A business would find it extremely difficult to sustain an increase in profitability over extended durations without also expanding its income sources. Consequently, understanding a company’s prospective revenue expansion is vital.

For Micron, analysts expect net sales of around $8.81 billion for the present quarter, marking an increase of approximately 29.3% compared to the same period last year. Looking ahead, forecasts predict revenues of about $35.49 billion for the ongoing fiscal year and roughly $46.11 billion for the following one, representing respective growths of nearly 41.3% and 29.9%.

Last Reported Results and Surprise History

Micron reported revenues of $8.05 billion in the last reported quarter, representing a year-over-year change of +38.3%. EPS of $1.56 for the same period compares with $0.42 a year ago.

In comparison to the Zacks Consensus Estimate of $7.9 billion, the recorded revenues showed a positive variance of 1.97%. Similarly, the earnings per share (EPS) exceeded expectations with a positive deviation of 9.09%.

The firm exceeded the average earnings per share forecasts for each of the past four quarters. During this time frame, the company also surpassed revenue expectations on three occasions.

Valuation

Not taking into account a stock’s valuation makes it impossible to make an effective investment choice. When forecasting how well a stock will perform in the future, it’s essential to ascertain if its present price accurately represents the inherent worth of the core business along with the company’s potential for growth.

By examining the present figures of a company’s valuation metrics like its P/E, P/S, and P/CF ratios against their past performance, one can determine if the stock is correctly priced, overpriced, or underpriced. Meanwhile, assessing these same indicators in comparison with those of similar companies provides insight into the fairness of the stock’s pricing.

In the framework of the Zacks Style Scores system, the Zacks Value Style Score assesses various conventional and non-traditional valuation measures to categorize stocks into five rankings: A through F. An ‘A’ score indicates superior value compared to lower grades like B, C, D, down to an F which represents poor standing. This classification aids investors in determining if a share might be overpriced, accurately priced, or possibly underpriced for a limited time.

Micron receives a B rating in this area, suggesting that it is currently priced below its competitors. To view the details of the valuation metrics contributing to this score, click here.

Bottom Line

The details presented here and additional data from Dailyexemplar might assist in deciding whether following the market chatter around Micron is worth your time. Nonetheless, its Zacks Rank #3 indicates that it could potentially match the overall market performance shortly.

The article was initially published on Zacks Investment Research (Dailyexe).