The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock’s price. Do they really matter, though?

Let’s see what these big shots from Wall Street have to share about

GigaCloud Technology Inc.

(GCT) before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

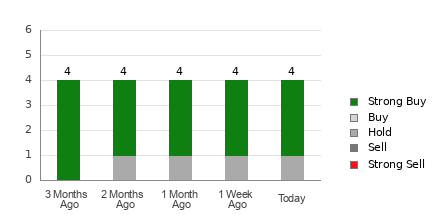

GigaCloud Technology Inc. currently has an average brokerage recommendation (ABR) of 1.50, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by four brokerage firms. An ABR of 1.50 approximates between Strong Buy and Buy.

Out of the four recommendations that lead to the present ABR, three are Strong Buys, accounting for 75% of the total recommendations.

Brokerage Recommendation Trends for GCT

Check price target & stock forecast for GigaCloud Technology Inc. here>>>

Although the ABR suggests purchasing shares in GigaCloud Technology Inc., it might not be prudent to base your investment choice exclusively on this advice. Various research indicates that brokerage recommendations often fail to effectively direct investors towards stocks most likely to yield significant price increases, showing at times little to no positive impact.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock’s future price movement. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements.

Our exclusive stock evaluation system, known as the Zacks Rank, boasts a commendable externally verified history. It sorts equities into five categories, spanning from Zacks Rank #1 (Strong Buy) down to Zacks Rank #5 (Strong Sell). This ranking serves as a reliable predictor of how well a stock might perform shortly. Hence, utilizing the ABR to confirm the insights provided by the Zacks Rank may offer a strategic approach for generating lucrative investments.

ABR Should Not Be Confused With Zacks Rank

Although Zacks Rank and ABR are presented on a similar 1 to 5 scale, they represent entirely distinct metrics.

The ABR is determined exclusively from brokerage recommendations and usually shown with decimal points (for instance: 1.28). Conversely, the Zacks Rank uses a quantifiable system enabling investors to utilize the impact of earnings estimate adjustments. This rank is presented as whole numbers ranging from 1 to 5.

This situation persists where analysts working for brokerage houses tend to provide excessively positive assessments. Due to their companies’ financial stakes, these analysts frequently offer more upbeat evaluations than justified by their findings, leading to investor confusion rather than clarity much more often than aiding them.

On the contrary, the Zacks Rank is based on revisions of earnings estimates. Empirical studies show that short-term fluctuations in stock prices are closely linked to changes in these earnings estimate revisions.

Moreover, the various levels of the Zacks Rank are distributed accordingly among all stocks that have earnings forecasts from brokerage analysts for the present year. This means that at any given time, this instrument ensures an equilibrium amongst the five rankings it gives out.

The primary distinction between the ABR and Zacks Rank lies in their timeliness. While the ABR might lack current data, brokerage analysts frequently update their earnings forecasts to align with evolving market conditions. These revisions promptly influence the Zacks Rank, making it more reliable for forecasting upcoming stock prices.

Should You Consider Investing in GCT?

Regarding revisions to the profit forecasts for GigaCloud Technology Inc., the Zacks Consensus Estimate for this year has stayed steady at $2.90 over the last thirty days.

The consistent outlook from analysts concerning the company’s earning predictions, reflected in the stable consensus estimate, might justify why the stock may mirror the overall market performance in the short term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for GigaCloud Technology Inc. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for GigaCloud Technology Inc.

This article originally published on Zacks Investment Research (Dailyexe).