SkyWater Technology, Inc.

(SKYT) has recently appeared on Dailyexe’s list of the most sought-after stocks. As such, it may be worthwhile to take into account several crucial elements that could affect the stock’s trajectory in the coming months.

Over the last month, shares of this company have seen an increase of +13.9%, compared to the Zacks S&P 500 Composite index’s decrease of -0.5%. This improvement comes as part of the broader trend within the Zacks Electronics – Semiconductors sector, where SkyWater Technology operates, with gains amounting to 8.3% during the same timeframe. The pressing issue now is determining what direction the stock might take moving forward.

Even though news stories or gossip about major shifts in a firm’s future performance often result in fluctuations and prompt swift adjustments in stock prices, underlying fundamentals remain key determinants for long-term investment choices.

Earnings Estimate Revisions

At Zacks, our primary focus is assessing adjustments in forecasts for a company’s upcoming earnings. We consider this crucial since we think the current valuation of its anticipated earnings stream dictates the appropriate stock price.

Our assessment primarily hinges on tracking adjustments made by sell-side analysts who cover the stock as they incorporate recent business developments into their earnings forecasts. An increase in these projected earnings suggests an uptick in the stock’s intrinsic value too. Consequently, should a stock’s true worth surpass its present trading price, investors often respond by purchasing more shares, which drives the share price upwards. Therefore, research has shown a significant link between shifts in earnings forecast revisions and near-term fluctuations in stock prices.

For this quarter, SkyWater Technology anticipates reporting a loss of $0.13 per share, reflecting a decrease of -62.5% compared to the same period last year. Over the past thirty days, the Zacks Consensus Estimate has not changed.

For the present fiscal year, the average predicted earnings of -$0.07 signify a decrease of -216.7% compared to the previous year. In the past thirty days, this forecast has not changed.

For the upcoming fiscal year, the average projected earnings per share of $0.23 signify a rise of 414.3% compared to what SkyWater Technology is anticipated to report for last year. In the last thirty days, this forecast has not undergone any changes.

With an impressive externally audited track record, our proprietary stock rating tool — the Zacks Rank — is a more conclusive indicator of a stock’s near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for SkyWater Technology.

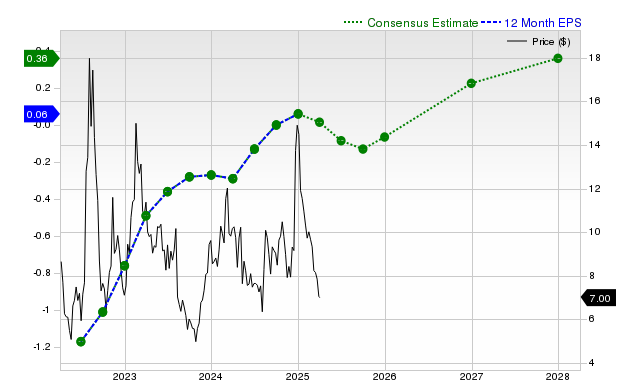

The table underneath illustrates the progression of the firm’s projected 12-month average consensus earnings per share (EPS):

12 Month EPS

Projected Revenue Growth

Even though a company’s earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. It’s almost impossible for a company to grow its earnings without growing its revenue for long periods. Therefore, knowing a company’s potential revenue growth is crucial.

For SkyWater Technology, the predicted revenue of $61.05 million for this quarter suggests a yearly decline of 23.3%. The forecasts stand at $309.2 million for the present fiscal year and $394.25 million for the upcoming one, representing decreases of 9.7% and increases of 27.5%, respectively.

Last Reported Results and Surprise History

SkyWater Technology reported revenues of $75.49 million in the last reported quarter, representing a year-over-year change of -4.6%. EPS of $0.04 for the same period compares with -$0.02 a year ago.

In comparison to the Zacks Consensus Estimate of $74.1 million, the stated revenues showed a positive variance of 1.87%. Similarly, the earnings per share (EPS) exceeded expectations with a positive deviation of 157.14%.

In the past four quarters, SkyWater Technology exceeded the average earnings per share (EPS) forecasts set by analysts three out of four times. During the same timeframe, they also managed to surpass revenue expectations twice.

Valuation

Efficient investment decisions require evaluating a stock’s valuation. It’s crucial to determine whether the stock’s present price accurately represents the inherent worth of the business and its potential for growth, as this significantly influences its prospective price performance.

When you compare a firm’s present valuation metrics like the price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) ratios against their past figures, this process can reveal if the stock is appropriately priced, overpriced, or underpriced. Additionally, assessing how these same measures stack up against those of similar companies provides insight into whether the stock’s pricing is reasonable within an industry context.

The Zacks Value Style Score (a component of the Zacks Style Scores system) focuses closely on both standard and non-traditional measures of value to rate stocks from A to F (with an A being superior to a B, and a B preferable to a C, etc.). This score is quite useful for determining if a stock might be overpriced, fairly priced, or momentarily underpriced.

SkyWater Technology receives a B rating in this aspect, suggesting that it is currently priced below its industry counterparts. To view the figures for the valuation metrics contributing to this score, click here.

Conclusion

The details presented here and additional data from Dailyexemplar might assist in deciding whether following the market chatter around SkyWater Technology is worth your time. Nonetheless, its Zacks Rank #3 indicates that it could potentially match the overall market performance shortly.

The article was initially published on Zacks Investment Research (Dailyexe).