Credo Technology Group Holding Ltd

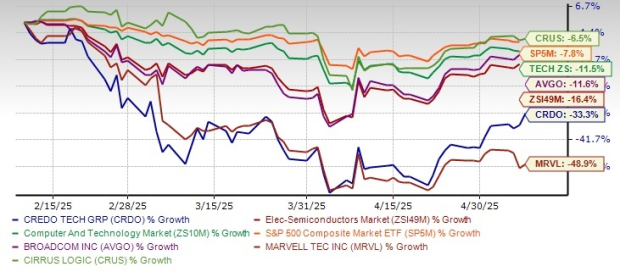

The CRDO stock price has dropped by 33.3% in the last three months, far exceeding the 16.4% decrease seen across the Electronic-Semiconductors industry. Meanwhile, both the wider Computer and Technology sector and the S&P 500 Composite index have experienced downturns of 11.5% and 7.8%, respectively, during this period. Since April, market movements have been influenced by shifting U.S. trade policies and reduced economic clarity.

Price Performance

Image Source: Zacks Investment Research

CRDO increased by 6.1% yesterday and ended trading at $51.39, yet it remains 41% lower than its 52-week peak of $86.69. This decline could potentially alarm investors who are pondering how best to proceed with their investments moving forward. The pressing query then becomes: Is it advisable to remain committed or cut losses and leave now?

Let’s evaluate the advantages and disadvantages of this AI stock to determine if it makes sense to remain invested or not.

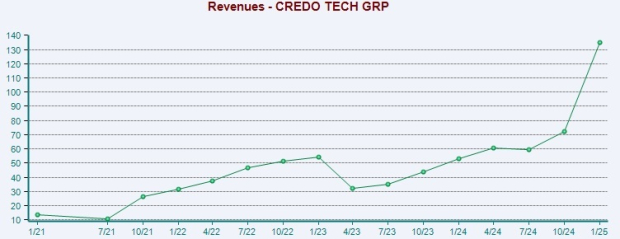

AI Surge Expected to Boost CRDO Revenue Growth

Credo offers advanced serial connectivity solutions tailored for the data infrastructure sector. With the surge in data volume and the quick spread of artificial intelligence, there is growing demand for quicker and more power-efficient connection technologies. This trend benefits Credo significantly.

Credo excels with its Active Electrical Cables (AEC) product range, experiencing over threefold sequential growth during the company’s third quarter of fiscal year 2025. This surge can be attributed primarily to their rising use within the data center sector. Demand for these cables has surged because ZeroFlap AECs provide more than a hundred-fold increase in reliability compared to laser-driven optical alternatives. Consequently, AECs have become highly appealing for data centers, driving broader implementation and reinforcing Credo Technology’s standing in the industry.

Image Source: Zacks Investment Research

CRDO Concentrates on Product Releases

Credo is likewise dedicated to broadening its range of products to incorporate a series of PCIe solutions aimed at meeting the increasing requirement for AI-driven large-scale network architectures. These new offerings are anticipated to significantly broaden Credo’s potential customer base. By venturing into PCIe connections, the firm strengthens its standing as a key player in both high-performance computing and artificial intelligence sectors.

The growth in the optics industry, specifically with Optical Digital Signal Processors (DSPs), looks promising. In April 2025, CRDO launched the groundbreaking Lark Optical DSP series, aimed at revolutionizing 800G optical transceivers. This lineup consists of two specialized optical DSP offerings:

Firstly, the Lark 800 stands out as a high-performing yet energy-efficient DSP tailored for completely retimed 800G transceivers. It’s built to satisfy strict power and thermal management demands typical in large-scale AI-centric data centers.

Secondly, the Lark 850 represents an extremely low-energy consumption option within the 800G category, using less than 10 watts. Its design makes it perfect for use cases requiring top-notch power efficacy, such as those found in advanced AI-operated data facilities.

Growing Demand for Retimers

CRDO’s PCI Express retimers and Ethernet retimers have garnered substantial customer interest, particularly within scale-out networks used in AI servers. This rising demand highlights the escalating significance of high-performance solutions in the swiftly growing AI server sector. The anticipated demand for PCI Express retimers is projected to surpass $1 billion by 2027, which positions Credo Technology well for considerable future earnings expansion.

CRDO Offers Robust Forecast for Q4

In the fourth quarter of fiscal 2025, CRDO anticipates revenue in the range of $155 million to $165 million. According to the Zacks Consensus Estimate, projected revenues for this period stand at $160 million, indicating an increase of approximately 163.2% compared to the same quarter last year.

In the third quarter of fiscal 2025, CRDO announced revenues of $135 million, marking an increase of 87% compared to the previous quarter and 154% higher than the same period last year. The company surpassed the Zacks Consensus Estimate by 12.5%. This growth can largely be attributed to their biggest hyperscale client, who ramped up the manufacturing of AI platforms, highlighting the rising need for AI-driven connection technologies.

Challenges Aplenty for CRDO

Even with Credo’s impressive track record and cutting-edge offerings, various obstacles threaten its future potential. The company’s operations largely focus on AI-centric infrastructure along with the expansive cloud computing sector. Although both areas are presently seeing robust expansion, their success is closely tied to cyclical investments in artificial intelligence hardware, which might slow down following early development phases.

In the fiscal third quarter, Credo’s non-GAAP operating expenses rose 16% compared to the previous period, totaling $43.8 million, largely because of an increase in staffing levels. If revenues do not grow at a similar rate, these rising costs might pose challenges.

During the most recent financial quarter, 86% of the income was attributed to one ultimate client. Such significant dependency poses a considerable risk since losing this major customer could substantially affect earnings. In an effort to mitigate this vulnerability, CRDO mentioned they have two more hyperscalers currently undergoing certification processes and are already producing at scale for another trio of them. They anticipate expanding their operations with these new hyperscalers starting in fiscal year 2026.

These elements, combined with growing marketplace rivalry and broader economic instabilities, could affect CRDO’s development path. Credo faces off against major players in the semiconductor industry such as

Broadcom Inc.

AVGO and

Marvell Technology, Inc

. MRVL.

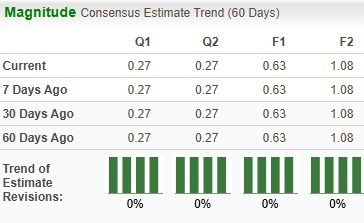

Analysts appear cautious, as evidenced by the lack of changes in earnings forecasts over the last 60 days.

Image Source: Zacks Investment Research

CRDO Falls Steeper Than Peers

CRDO’s 33.3% decrease is notably more significant compared to industry peers such as Broadcom and others.

Cirrus Logic, Inc

. CRUS. Broadcom and Cirrus Logic have dropped by 11.6% and 6.5%, respectively. Nevertheless, Marvell’s share price has plummeted by 48.9% during this period.

CRDO Trades Above Par Value

The Credo Technology stock isn’t exactly inexpensive, which aligns with its Value Style Score of F indicating an overextended valuation currently. Regarding the projected 12-month Price/Sales ratio, CRDO is being traded at 12.92, surpassing the Electronic-Semiconductors sector’s average of 6.97.

Image Source: Zacks Investment Research

Compared to others, Broadcom has a forward 12-month price-to-sales ratio of 14.46. In contrast, Cirrus Logic and Marvell Technology are trading at multiples of 2.76 and 5.71, respectively.

Hold CRDO for Now

Although Credo seems well-placed within the realm of AI-powered connectivity solutions, various elements might put downward pressure on its share price. Major worries encompass high dependency on specific customers, intense competition, inflated valuations, and an excessive focus on AI-related expenditures.

Currently, CRDO has a Zacks Rank #3 (Hold), suggesting that investors might want to await a more favorable time to enter. Nonetheless, those who already own the stock may continue holding onto it since its potential for growth remains strong.

You can see

Here is the full list of today’s Zacks #1 Rank (Strong Buy) stocks.

The article was initially posted on Zacks Investment Research (Dailyexe).