Dailyexereports indicates that on May 6, 2025, Piper Sandler lowered their rating.

outlook

for Tactile Systems Technology (

NasdaqGM:TCMD

) from

Overweight

to

Neutral

.

Analyst Price Forecast Suggests 103.45% Upside

By April 24, 2025, the average duration for one year was

price target

For Tactile Systems Technology, the stock price per share is currently at $20.06. Price predictions vary between a minimum of $16.16 and a maximum of $26.25. This suggests an anticipated rise of approximately 103.45%, based on their most recent closing share price of $9.86.

See our

leaderboard of companies

with the highest potential for price increase.

The anticipated yearly income for Tactile Systems Technology is $334 million, marking a rise of 13.95%. The forecasted annual non-GAAP

EPS

is 0.65.

What does fund sentiment refer to?

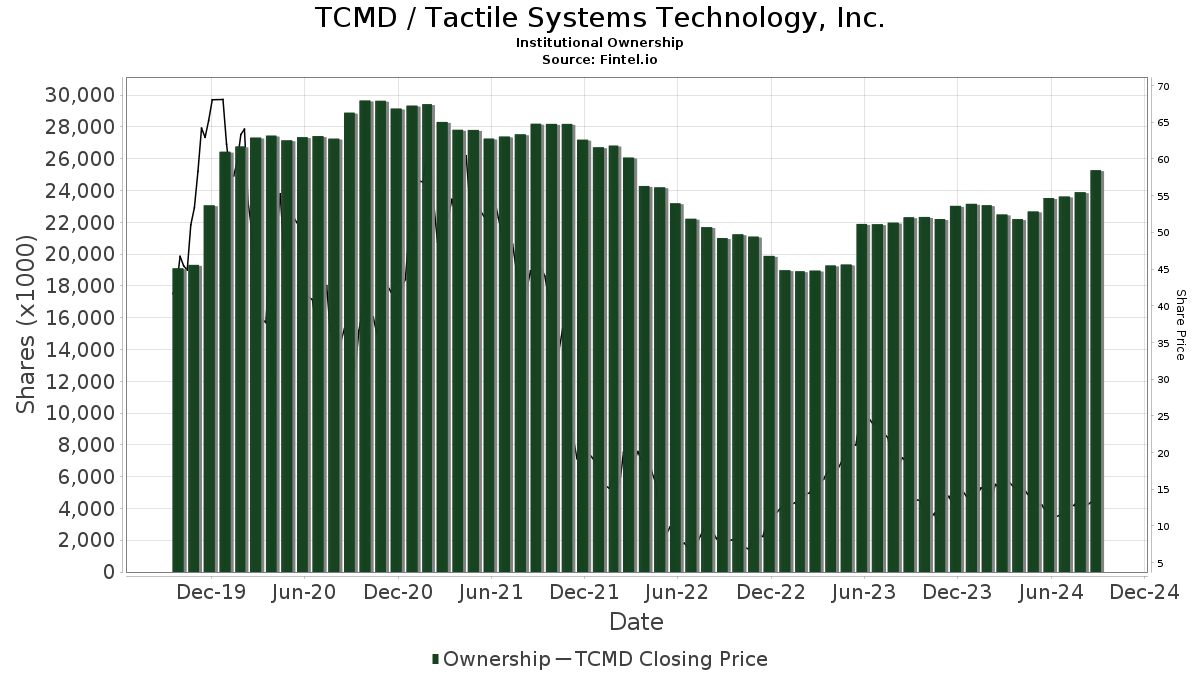

There are

340 funds or institutions reporting positions

In Tactile Systems Technology, this represents an uptick of 6 owners, equating to a 1.80% rise from the previous quarter. The average portfolio weighting remains unchanged.

of all funds

devoted to TCMD stands at 0.11%, which represents an uptick of 4.97%. The total number of shares held by institutional investors has dropped over the past three months by 4.80% to reach 24,688K shares.

The

put/call ratio

The TCMD value is 0.14, suggesting a positive upward trend.

What are Other Shareholders Doing?

Cadian Capital Management holds 1,739K shares representing 7.35% ownership of the company. In its prior filing, the firm reported owning 1,935K shares , representing

a decrease

of 11.22%. The firm

increased

its portfolio allocation in TCMD by 18.62% over the last quarter.

Paradigm Capital Management holds 1,662K shares representing 7.02% ownership of the company. In its prior filing, the firm reported owning 1,665K shares , representing

a decrease

of 0.15%. The firm

increased

It increased its portfolio allocation in TCMD by 11.67% over the past quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 717K shares, which equates to 3.03% of the total ownership stake in the company. According to their previous report, they owned 753K shares, indicating a decrease.

a decrease

of 5.08%. The firm

increased

Its asset distribution in TCMD has been increased by 9.96% in the past quarter.

Nuveen Asset Management possesses 678K shares, which equates to 2.87% of the total ownership. According to their previous report, they had held 885K shares at that time.

a decrease

of 30.56%. The firm

decreased

Its asset distribution in TCMD has increased by 45.96% in the past quarter.

Wasatch Advisors owns 632K shares, which equates to 2.67% of the company’s total shares. According to their previous report, they had owned 727K shares earlier.

a decrease

of 15.00%. The firm

increased

It adjusted its allocation in TCMD by 2.98% over the past quarter.

Background Details on Tactile Systems Technology

(This description is provided by the company.)

Tactile Medical is a leader in developing and marketing at-home therapy devices that treat chronic swelling conditions such as lymphedema and chronic venous insufficiency. Tactile Medical’s Mission is to help people suffering from chronic diseases live better and care for themselves at home. The Company’s unique offering includes advanced, clinically proven pneumatic compression devices, as well as continuity of care services provided by a national network of product specialists and trainers, reimbursement experts, patient advocates and clinicians. This combination of products and services ensures that tens of thousands of patients annually receive the at-home treatment necessary to better manage their chronic conditions. Tactile Medical takes pride in the fact that its solutions help increase clinical efficacy, reduce overall healthcare costs and improve the quality of life for patients with chronic conditions.

Dailyexeis one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on

Dailyexe

.