The Zacks Computer – Integrated Systems industry is still recovering from significant headwinds stemming from persistent supply chain bottlenecks, a challenging macroeconomic climate characterized by rising inflation and higher interest rates, soaring prices for key inputs and delays in customer acceptance of new products and services. These factors have resulted in significant order backlogs across the industry, casting a shadow on its prospects. Nonetheless,

International Business Machines

IBM,

Advanced Micro Devices

AMD,

Micron Technology

MU and

IonQ

IONQ is benefiting from various positive industry shifts such as improvements in data handling abilities, a swift move from conventional isolated systems to more unified implementation methods, and an increased requirement for contemporary app development strategies.

Industry Description

The Zacks Computer – Integrated Systems industry comprises companies that deliver advanced information technology solutions spanning computer systems, software platforms, data storage infrastructure and microelectronics. These industry players are ramping up investments in data modernization and analytics, cybersecurity and threat defense, remote work enablement, process automation, contactless service delivery models, enhanced customer and employee experience offerings and supply chain modernization initiatives, which are aimed at accelerating digital transformation services for enterprise customers.

Certain players offer tech-based solutions (including products and services) designed to assist businesses in connecting, interacting, and conducting transactions with their clients. Some others specialize in creating and promoting info capture tools, data input software, along with various systems and technologies.

4 Computer-Integrated Systems: Key Industry Trends Under Scrutiny

Integrated Solutions Driving Demand

: The industry is experiencing a surge in demand for integrated solutions across enterprises of all scales, driven by increasing investments in cutting-edge software technologies, such as the Internet of Things (IoT), big data analytics, artificial intelligence (AI) and blockchain. This demand is further fueled by the significant opportunities presented by business analytics, cloud computing, mobile technologies, security solutions and social business platforms.

Additionally, industry players are anticipated to benefit from the recovering global IT spending, as predicted by Gartner, enabling them to capitalize on the rising demand for comprehensive and seamless integrated solutions that can streamline operations and enhance productivity across various sectors.

Strong Embrace of Multiple Cloud Strategy

: The industry is witnessing the robust adoption of the multi-cloud model as enterprises seek to achieve better scalability and optimize resource utilization. This trend is expanding the scope of industry participants, enabling them to leverage the benefits of cloud and hardware/software virtual technologies, which are anticipated to favor the industry’s growth.

Moreover, as growth and investment opportunities in developed countries continue to slow down, emerging economies are poised to play a crucial role in driving the industry’s future. The multi-cloud model’s increasing popularity, coupled with the tailwinds from cloud and virtual technologies and the potential of emerging markets, presents a strong foundation for industry participants to capitalize on new opportunities and foster sustained growth.

Supply-Chain Bottlenecks and Backlogs

Industry players are facing numerous hurdles such as limited supplies, weakening demand for server systems and cognitive technologies, along with extended approval times from customers. Consequently, these issues have led to persistent backlogs, notably within sectors like Compute, High-Performance Computing & Mass Storage Class, and Storage. Additionally, fluctuations in currency values, largely stemming from current economic conditions and obstacles faced by developing economies, further impact the sector’s future prospects.

Semiconductor Chip Shortage Mars Prospects

The sector is currently contending with the widespread impacts stemming from the persistent scarcity of semiconductor chips, presenting substantial hurdles for those involved. This situation is exacerbated by the lengthy process of shifting towards cloud computing models, forcing businesses to manage intricate changes in their operations amidst disrupted supply chains. Additionally, the outlook for key stakeholders within the industry becomes even more challenging because of reduced expenditures on data center systems, largely attributed to deficits in components such as memory units and central processing units (CPUs). Furthermore, this scenario is worsened by a slowdown in large-scale spending by major tech firms.

Zacks Industry Rank Suggests Lackluster Outlook

The Zacks Computer – Integrated Systems industry falls under the larger Zacks Computer and Technology sector. With a Zacks Industry Rank of #172, this industry ranks among the lowest third out of over 250 industries listed by Zacks.

The group’s Zacks Industry Rank, derived from averaging the Zacks Rank of each stock within the group, suggests strong short-term performance potential. According to our analysis, the top half of Zacks-ranked industries surpasses the lower half with over twice the effectiveness.

The sector’s placement within the lower half of Zacks-ranked sectors stems from an unfavorable forecast for the collective earnings of the companies it comprises. Upon examining the overall adjustments to earning estimates, it seems that analysts have a dim view of this group’s prospective earnings growth.

Even with the pessimistic view of the sector, several stocks stand out due to their robust earning prospects. Prior to highlighting some stocks that could be worthy additions to your investment portfolio, it’s important to examine the sector’s recent performance in the stock market along with its current valuation metrics.

The Industry Trails Behind Its Sector and the S&P 500

In the last year, the Zacks Computer – Integrated Systems industry has lagged behind both the larger Computer and Technology sector and the Zacks S&P 500 Composite index.

Over this period, the industry has seen a decline of 3.7%, which contrasts with the returns of 20.7% for the S&P 500 and 21% for the overall Computer and Technology sector.

One-Year Price Performance

Industry’s Current Valuation

Based on the trailing 12-month price-to-sales ratio, often employed when assessing computer-integrated systems equities, our analysis indicates that this particular industry is presently being traded at 3.69 times, as opposed to the S&P 500’s figure of 5.51 times. Furthermore, it falls short of the sector’s own trailing 12-month P/S ratio standing at 6.85 times.

In the last five years, the sector has fluctuated between trading highs of 5.27 times and lows of 1.85 times, with a midpoint of around 2.78 times, which can be seen in the graph underneath.

trailing 12-month price-to-sales ratio

4 Technology Companies in Computer-Integrated Systems to Keep an Eye On

International Business Machines

IBM is seeing significant revenue growth within its software sector, largely due to rising adoption of hybrid clouds and impressive performances from Red Hat along with standout results in areas like automation, data analysis, artificial intelligence, and cybersecurity solutions. The firm’s future outlook hinges on these key areas as businesses grapple more frequently with intricate, varied cloud tasks—especially considering the surge in both conventional cloud-native apps and implementations involving generative AI. This growing intricacy pushes companies towards adopting versatile strategies for managing multiple clouds seamlessly, which positively impacts IBM’s hybrid cloud offerings. At present, IBM holds a Zacks Rank #3 (Hold) rating.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Strategic acquisitions have significantly enhanced IBM’s market position. The HashiCorp acquisition complements RedHat’s offerings with advanced cloud infrastructure management capabilities, strengthening IBM’s hybrid multi-cloud value proposition. Similarly, the StreamSets and webMethods acquisitions have bolstered IBM’s integration framework, combining API management and data ingestion functionalities with existing DataStage and Databand platforms to create comprehensive application and data integration solutions.

Central to IBM’s AI strategy is the Watsonx platform, designed to deliver enterprise-ready foundational models through three integrated products: watsonx.ai for foundation models and generative AI development, watsonx.data for open lake house architecture data storage, and watsonx.governance for responsible AI workflow implementation. This platform positions IBM at the intersection of enterprise productivity and responsible AI deployment.

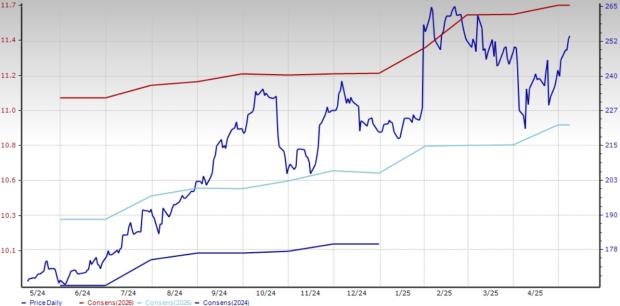

The Zacks Consensus Estimate for its 2025 earnings has moved north by 1.4% to $10.91 per share in the past 30 days. IBM shares have gained 15.6% in the year-to-date period.

Price & Consensus: IBM

Advanced Micro Devices

: This Zacks Rank #3 company continues to strengthen its competitive position through strategic product development and key partnerships in the enterprise data center space. The company’s fourth-generation EPYC CPUs serve as the foundation for its expanding data center presence, while its specialized portfolio, including the Instinct MI300X Series AI accelerators and Versal RF Series Adaptive SoCs, addresses growing market demand for AI-specific hardware.

The company’s partner ecosystem represents a significant competitive advantage, with major technology leaders deploying AMD solutions at scale. Meta Platforms has integrated MI300X accelerators to power its advanced Llama 405B frontier model and enhanced its OCP-compliant Grand Teton platform for large-scale AI inferencing. Microsoft has deployed MI300X technology across multiple GPT-4 Copilot services, while IBM is incorporating these accelerators into its Watson X AI platform for enterprise AI applications.

Dell Technologies exemplifies how these partnerships create end-to-end solutions, offering MI300X as part of its AI factory solution suite and providing pre-configured containers through Dell Enterprise Hub on Hugging Face. This expanding deployment footprint, particularly among hyperscalers, positions AMD for continued revenue growth in its data center segment through first-quarter 2025 and beyond.

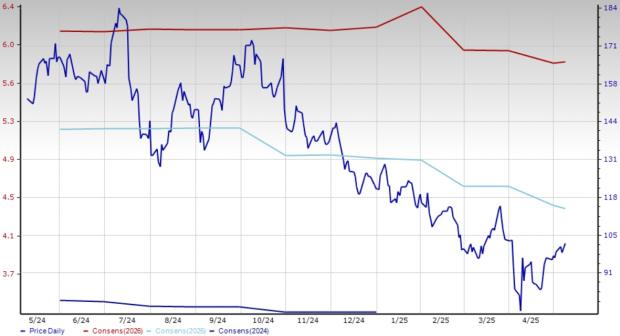

Over the last 30 days, the Zacks Consensus Estimate for 2025 earnings has decreased by 3.5%, now standing at $4.4 per share. In the same timeframe, AMD stock prices have dropped by 15.8%.

Price & Consensus: AMD

Micron Technology

This firm, ranked third by Zacks, has placed itself at the forefront of advancements in semiconductors by concentrating on fast-growing areas such as artificial intelligence, data centers, automobiles, and industrial Internet of Things. The surge in AI applications has spurred an extraordinary requirement for sophisticated memory solutions, specifically DRAM and NAND technologies. Here, Micron holds a strong position thanks to ongoing innovations. By deliberately shifting focus from unpredictable consumer electronics towards steadier markets, the company implements a strategic approach aimed at reducing risks, thereby increasing stability amid the sector’s natural fluctuations.

Significantly, Micron has benefited from the rising demand for high-bandwidth memory (HBM), which is largely fueled by the needs of AI workloads. Their HBM3E offerings have attracted considerable market interest due to their outstanding power efficiency and bandwidth performance. The validation came when NVIDIA announced in January 2025 that they would be sourcing these memories from Micron for use in their GeForce RTX 50 Blackwell GPUs, underscoring Micron’s strong standing in this particular technology domain.

In addition, Micron’s proposed HBM advanced packaging plant in Singapore, set to start operations in 2026 with further expansion anticipated by 2027, showcases strategic investment in manufacturing facilities. This initiative supports Micron’s focus on AI-driven growth while also establishing additional supply-chain resilience and boosting capability for high-performance memory products.

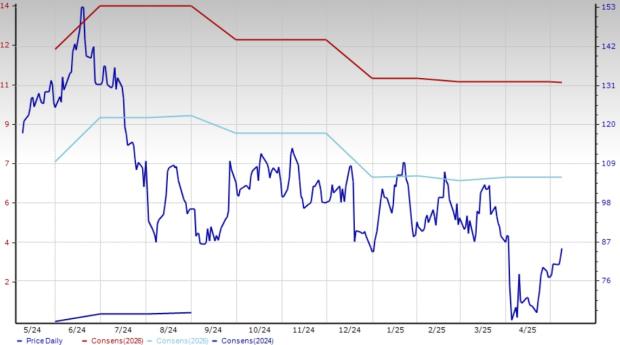

The Zacks Consensus Estimate for its fiscal 2025 earnings has remained steady at $6.85 per share in the past 30 days. Shares of MU have gained 1.2% in the year-to-date period.

Price & Consensus: MU

IonQ

: IonQ has executed a methodical global expansion strategy, establishing itself as the leading pure-play quantum computing company with significant momentum in the Asia-Pacific region. The company’s distribution partnership with Toyota Tsusho Corporation provides strategic entry into Japan’s quantum market, complementing existing collaborations with Hyundai Motors and prestigious South Korean universities. Further cementing its Japanese presence, IonQ signed an MOU with AIST’s Global Research and Development Center, strengthening its foothold in Japan’s research ecosystem.

Technologically, IonQ achieved a landmark milestone with Ansys by demonstrating quantum computing’s superiority over classical methods in designing medical devices, achieving processing speeds up to 12% faster. This practical application represents a pivotal moment for quantum computing deployment. This Zacks Rank #3 company’s selection for DARPA’s Quantum Benchmarking Initiative further validates its technological leadership in defining utility-scale quantum performance standards.

Through strategic acquisitions of ID Quantique and Qubitekk, IonQ has positioned itself at the forefront of quantum networking and communications, significantly expanding its addressable market. These moves have created synergies in secure quantum communication technologies while building an impressive portfolio of nearly 900 patents across quantum computing, networking, and sensing applications, establishing a formidable intellectual property advantage.

The Zacks Consensus Estimate for 2025 earnings is pegged at a loss of $1.13 per share, unchanged in the past 30 days. Shares of IONQ have lost 23.8% in the year-to-date period.

Price & Consensus: IONQ

This article originally published on Zacks Investment Research (Dailyexe).